Shareholding Structures

Funded Projects

- Construction materials

- Portable water purification and distribution

- Timber processing

- Furniture manufacturing

- Meat processing

- Organic and chemical fertiliser manufacturing

- Engineering projects

- Silicates manufacturing

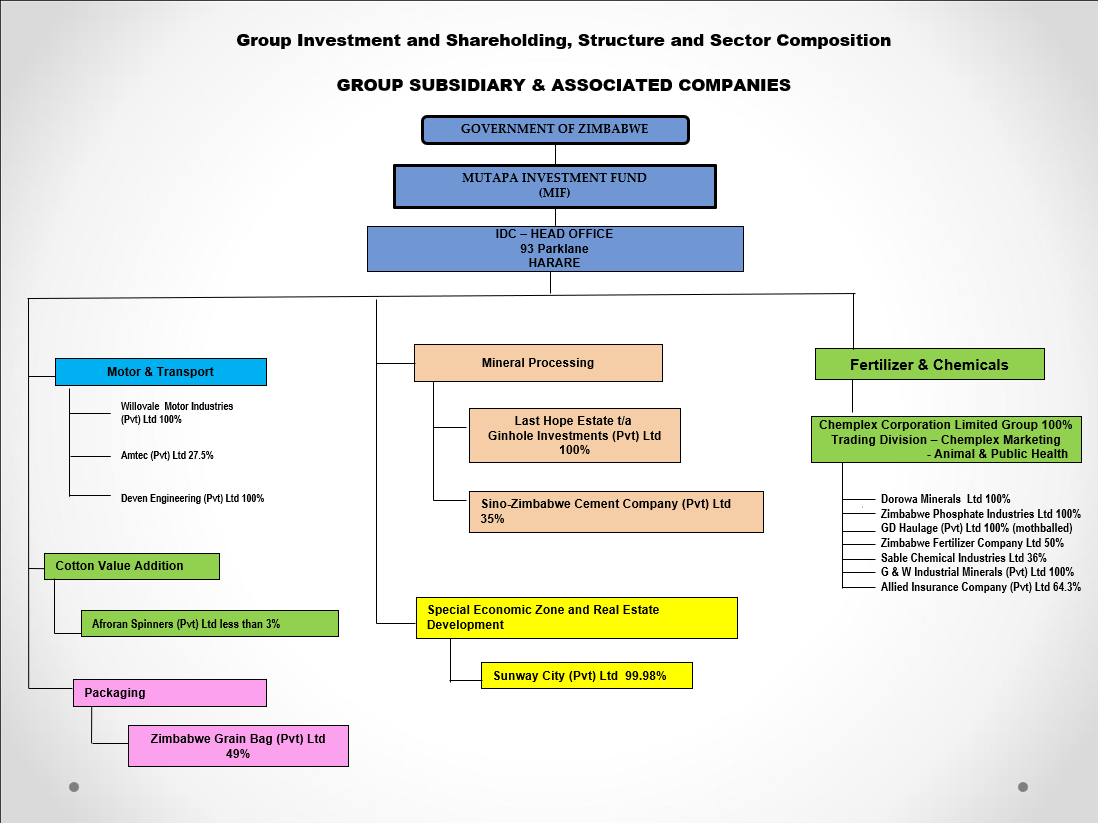

Group Investment and Shareholding, Structure and Sector Composition

GROUP SUBSIDIARY & ASSOCIATED COMPANIES.

GROUP SUBSIDIARY & ASSOCIATED COMPANIES.

Visit Us Today

- ADDRESS: 93 Park Lane Street, Harare

- PHONES: +263 242 706 971-5, 250 405, 796 029

- WE ARE OPEN: Mon – Fri, 0800hrs to 1600hrs GMT +2